Archive

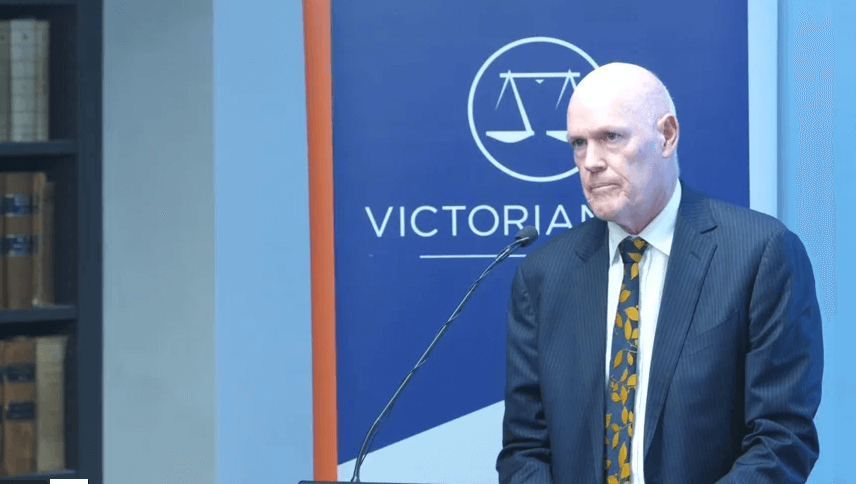

Michael Flynn QC

Michael Flynn is a chartered accountant practising principally in the areas of taxation, administrative law, trusts and commercial law. He was national president of the Tax Institute in 2014 and is the co-author of two books: Death and Taxes and Drafting Trusts and Will Trusts in Australia, both published by Thomson Reuters…

View Profile →Showing all 5 results

Make No Mistake? The Michael Hayes Case

$77.00Make No Mistake? The Michael Hayes Case

Hosted by The Tax Bar Association, this online webinar about the recent Full Federal Court decision in Commissioner of Taxation v The Trustee for the Michael Hayes Family Trust [2019] FCAFC 226. The case deals with the doctrines of mistake and rectification in tax disputes as well as specific issues related to public trading trusts and superannuation.

Gareth Redenbach provides an overview of the case and its general implications for tax disputes. The session is chaired by Michael Flynn QC who appeared for the successful trustee.

Hart v Commissioner of Taxation

$77.00Hart v Commissioner of Taxation

This seminar examined the first decided case in which the Commissioner of Taxation disqualified a trustee of a self-managed superannuation fund for not being a fit and proper person and for various breaches of the Superannuation Industry (Supervision) Act 1993.

The Full Court Decision In Sandini: Tax Implications for Family Law Disputes & Rollover Provisions

$77.00The Full Court Decision In Sandini: Tax Implications for Family Law Disputes & Rollover Provisions

The Full Federal Court recently handed down a 2-1 decision in Ellison v Sandini Pty Ltd [2018] FCAFC 44 overturning the Federal Court below. An application for special leave to the High Court has been filed. The case may have substantial consequences for family law practitioners and more general implications for capital gains tax rollover relief. The presentation will explain the Full Federal Court decision, its technical basis and ramifications and identify practical steps practitioners can take to best protect their clients’ interests.

Ethical Considerations Affecting Government Litigants

$77.00Ethical Considerations Affecting Government Litigants

In a number of recent decisions courts have made adverse comments about the behaviour of government litigants. Parliament is also considering legislation designed to make the model litigant rules legally enforceable.

In this seminar the speakers review the model litigant guidelines and the recent decisions in FCT v Donoghue [2015] FCAFC 183; (2015) 237 FCR 316; Gould v DCT [2017] FCAFC 1, North West Melbourne Recycling Pty Ltd v Commr of SR (Vic) (No 2) [2017] VSC 726, Shord v FCT [2017] FCAFC 167, and Shord v FCT (No 2) [2018] FCAFC 27.

Bywater Investments – What did the High Court decide and What are the Implications for Corporate Residence?

$77.00Bywater Investments – What did the High Court decide and What are the Implications for Corporate Residence?

This CPD seminar discusses the High Court’s decision in the Bywater Investments case and the status of Esquire Nominees Ltd v FCT (1973) 129 CLR 177 after Bywater Investments. Dr Julianne Jaques also discusses lessons from Bywater for ensuring foreign subsidiaries remain non-resident.